“Ever spent $500,000 on satellite insurance only to realize the orbital insertion risks were way higher than your broker mentioned? Yeah, it’s a thing.”

If you’ve ever wondered why space-faring companies and governments pay hefty premiums for satellite insurance, the answer lies in understanding orbital insertion risks. These aren’t just buzzwords; they’re critical factors that determine whether your satellite makes it safely into space—or becomes another piece of expensive debris floating around Earth.

In this post, we’ll dive deep into orbital insertion risks. You’ll learn:

- The basics of how satellites are launched and insured.

- Why orbital insertion is so risky (and costly).

- Actionable tips to make smarter insurance decisions.

- A real-world example of when things went horribly wrong in orbit.

Table of Contents

- Key Takeaways

- Understanding Orbital Insertion Risks

- Choosing the Right Satellite Insurance

- Pro Tips for Satellite Owners

- Case Study: Space Mishaps That Changed Insurance Policies

- FAQs About Orbital Insertion Risks

Key Takeaways

- Orbital insertion failure rates can reach up to 10% for new launch vehicles.

- Satellite insurance premiums often cover catastrophic events but overlook operational mishaps.

- Thorough risk assessment before launch can save millions in claims later.

- Premium prices spike significantly if previous launches failed under the same provider.

What Are Orbital Insertion Risks?

Sending something as delicate as a satellite hurtling through space isn’t exactly child’s play. The journey from Earth’s surface to its final orbital position involves multiple stages—each fraught with danger:

- Launch Vehicle Failure: Rockets explode. Yup, plain and simple. SpaceX had its fair share of botched attempts before becoming the poster child of reliability.

- Incorrect Trajectory: One degree off, and instead of geostationary heaven, your satellite ends up in low-Earth purgatory.

- Fuel Miscalculation: Not enough fuel means no maneuverability once in space. Too much could destabilize the system altogether.

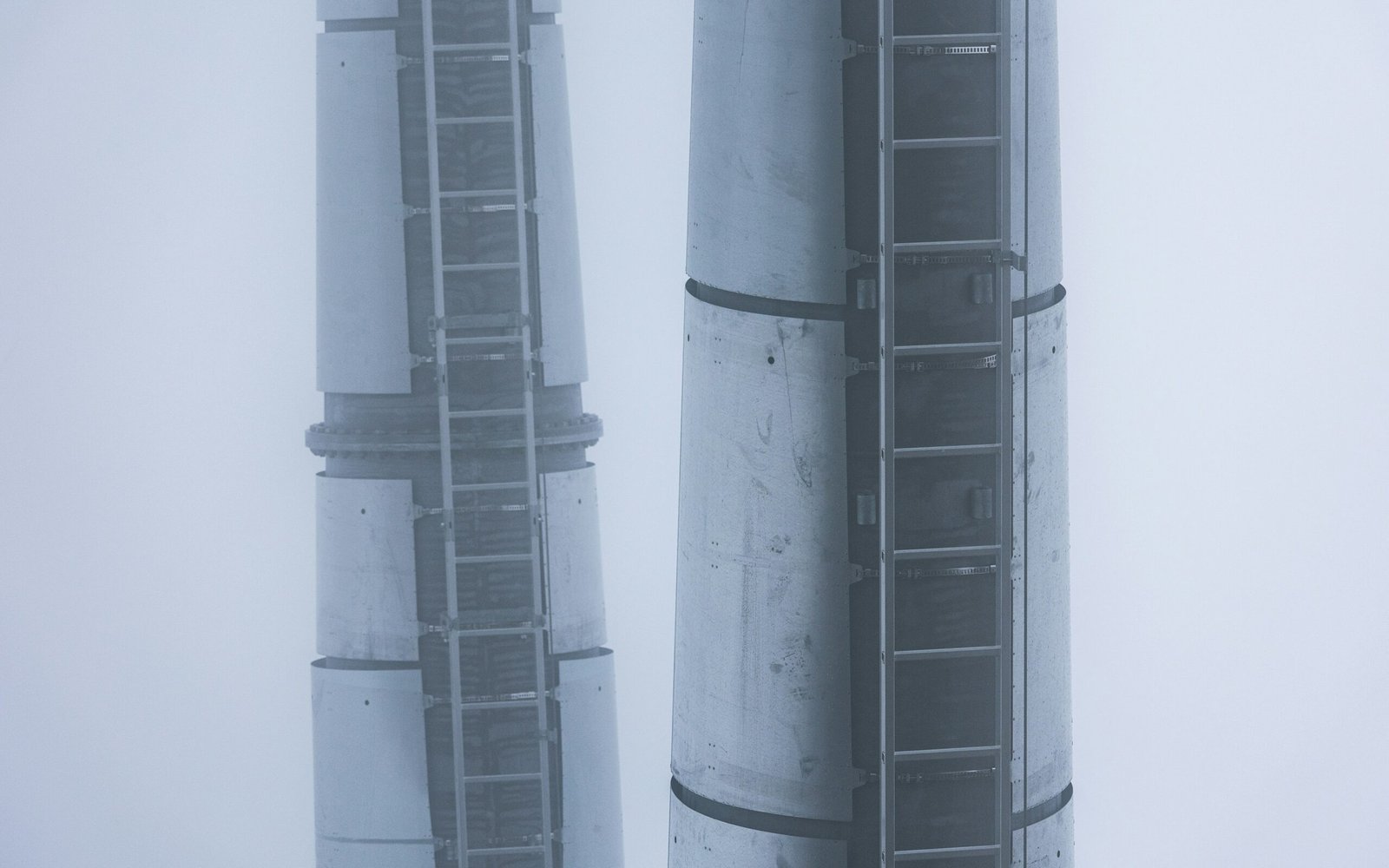

Figure 1: An illustration demonstrating common challenges during satellite deployment.

How Do You Choose the Best Satellite Insurance?

This part is tricky because…

Optimist You: “There *must* be some perfect policy out there!”

Grumpy You: “Ugh, fine—but prepare yourself for sticker shock.”

- Evaluate Historical Data: Look at past launch success rates. A company with five flawless missions will likely offer better odds—and lower premiums—than one trying their first rodeo.

- Check Policy Exclusions: Some insurers won’t cover anything beyond physical damage caused by crashes. Everything else? Well, good luck suing them.

- Consider Custom Coverage: Standard plans might exclude less obvious perils like solar flares or software malfunctions. Pay extra for add-ons if needed—it’s cheaper than losing $1B worth of tech.

Pro Tips for Reducing Orbital Insertion Risks

Here’s where I spill all the tea on what not to do (because trust me, someone already did):

I cannot stress this enough: Never skimp on pre-flight checks. “Surely skipping a few vibration tests won’t hurt,” said no engineer who didn’t later watch his lifework disintegrate mid-flight. Sound familiar? If the answer’s yes, don’t feel bad—you’re learning the hard way.

Chef’s Kiss Strategy:

“Simulations are unmatched for identifying weaknesses without burning actual cash.”

Case Study: When Ariane 5 Blew Up Spectacularly

You think your Monday was bad? In June 1996, European Space Agency’s Ariane 5 rocket self-destructed just 40 seconds after lift-off, taking four uninsured satellites along with it—a total loss exceeding €370 million. Lesson learned? Always test software updates thoroughly!

Figure 2: Visual representation highlighting outcome of software glitch leading to disaster.

Frequently Asked Questions About Orbital Insertion Risks

Are orbital insertion failures common?

No, they aren’t overly frequent thanks largely to rigorous testing protocols. However, emerging commercial players face slightly elevated risks compared to established giants like NASA or ESA.

Does standard satellite insurance include geostationary transfer?

Typically yes, though conditions may vary depending upon specific providers. Read those fine prints carefully!

Conclusion

Understanding orbital insertion risks isn’t merely about preventing disasters—it’s also about protecting investments and ensuring sustainable growth within the aerospace industry. By arming yourself with knowledge and picking stellar coverage partners, you set both feet firmly planted among stars while avoiding potential financial black holes.

And remember, even seasoned pros make mistakes sometimes. But hey—at least now you know better!

Satellites soar high Through skies vast and bright Yet risk looms nearby (Like forgotten Tamagotchis) Plan wisely, friend!