“What happens if my million-dollar satellite explodes during launch?” You’re not alone in asking this question.

For companies in the aerospace industry, pre-launch satellite insurance is no longer optional—it’s a necessity. Did you know that about 20% of all rocket launches fail? That’s right; one out of every five satellites doesn’t even make it past Earth’s atmosphere. But here’s the kicker: without proper coverage, these catastrophic events can bankrupt businesses overnight.

Table of Contents

- Key Takeaways

- Why Pre-Launch Satellite Insurance Matters

- How to Get Covered: A Step-by-Step Guide

- Best Practices for Buying Pre-Launch Insurance

- Real-World Example: Costly Mistakes and Successes

- FAQs About Pre-Launch Satellite Insurance

Key Takeaways

- The risk of launch failure is high, making pre-launch satellite insurance critical.

- Understand what your policy covers—launch vehicles, ground testing, etc.—to avoid costly surprises.

- Use specialized brokers to navigate the complex world of satellite insurance.

- Skipping insurance puts your entire project at financial risk—don’t do it!

Why Pre-Launch Satellite Insurance Matters

Let’s talk nightmares: imagine spending hundreds of millions developing a cutting-edge satellite only for its mission to end before it begins. I once saw a startup bet everything on their first launch—and lose big time because they didn’t have pre-launch coverage. They thought saving on premiums would be smart. Spoiler alert: it wasn’t.

From accidental damage during transport to technical glitches while conducting final tests, there are countless ways things can go wrong before liftoff. This is where pre-launch satellite insurance comes into play:

- Covers physical loss or damage from manufacturing through integration phases.

- Protects against unexpected setbacks like fires, explosions, or natural disasters.

- Includes liabilities arising from third-party damages incurred during prep work.

Grumpy Optimist Time:

Optimist You: “It’s okay; we’ve got safety protocols!”

Grumpy Me: “Yeah, until someone drops a wrench worth $5 million.”

How to Get Covered: A Step-by-Step Guide

If navigating the labyrinthine world of insurance feels daunting, follow these steps:

1. Assess Your Risks

List potential hazards based on past projects’ failures. Are you transporting components across continents? What about volatile weather conditions near the launch site?

2. Choose the Right Policy Type

There’s more than one flavor when it comes to pre-launch satellite insurance. Here are two popular choices:

- All-Risk Coverage: Protects against most risks except those explicitly excluded.

- Named Perils Policies: Covers specific perils listed in the contract.

3. Work with Specialized Brokers

You wouldn’t hire an intern to handle brain surgery, so why trust generic insurance agents? Seek out experts familiar with space tech—they speak your language.

4. Compare Quotes Wisely

Don’t rush into signing anything. Shop around, compare rates, and scrutinize fine print. Remember, cheaper isn’t always better.

5. Finalize Documentation

Double-check clauses related to deductibles, exclusions, and claim procedures. Sounds boring? Sure does—but skipping this step is chef’s kiss for future headaches.

Best Practices for Buying Pre-Launch Insurance

- Avoid Overconfidence Bias: Just because nothing went wrong last year doesn’t mean it won’t tomorrow.

- Understand Coverage Limits: Know exactly how much you stand to recover under various scenarios.

- Prioritize Transparency: Be upfront with insurers about your operations and challenges.

- Review Regularly: As your project evolves, revisit policies to ensure they still meet your needs.

- (Pro Tip!) Don’t Fall for Cheap Deals: If a deal sounds too good to be true, run fast. Fly-by-night providers might vanish faster than your deposit.

Rant Alert:

Ugh, let’s call out shady brokers who downplay the importance of comprehensive coverage just to close sales. They’re as annoying as that one coworker who insists AI will replace everyone next week. Spoiler: IT WON’T.

Real-World Example: Costly Mistakes and Successes

True Story: A European satellite operator opted for minimal pre-launch coverage due to budget constraints. Guess what happened? A freak lightning strike fried their equipment two days before the scheduled date. Without insurance, they ate a whopping $70M loss.

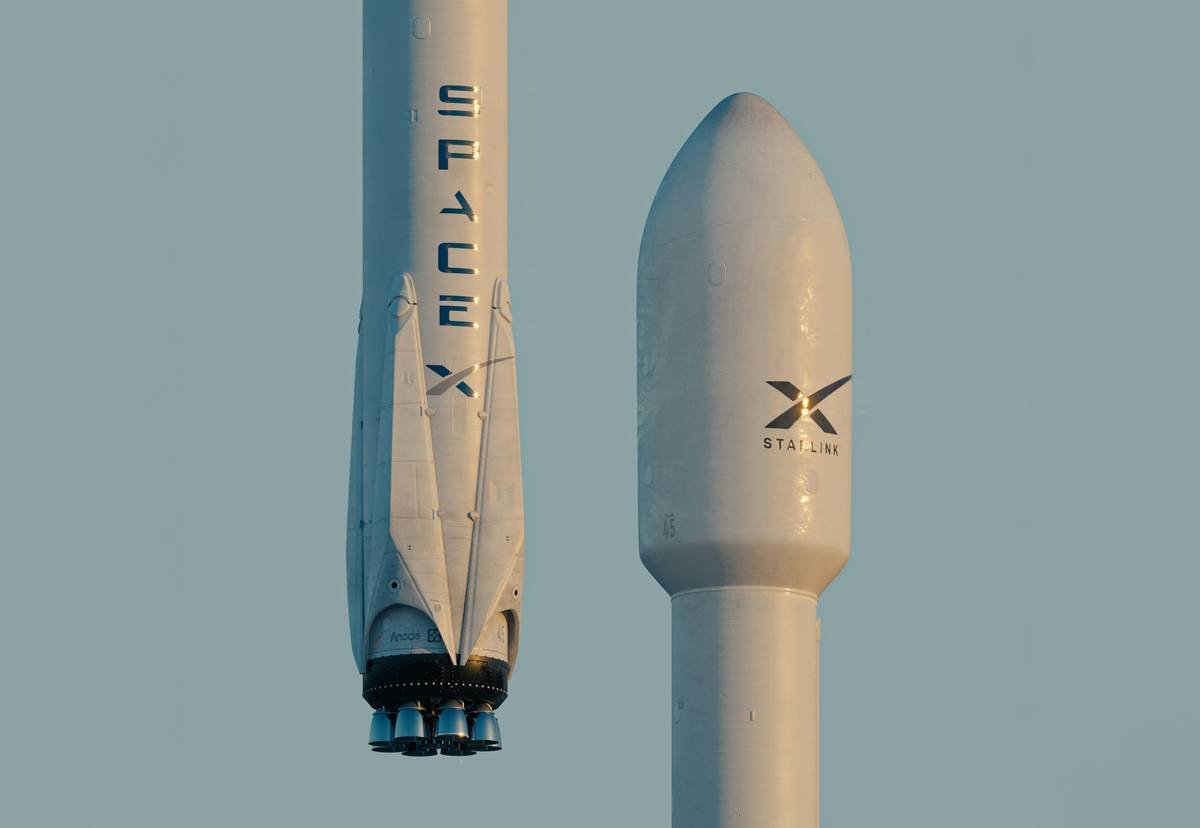

On the flip side, consider SpaceX. Their robust insurance strategy has helped them weather numerous failed attempts, ensuring steady growth despite setbacks. Lesson learned? Invest wisely now—or pay dearly later.

FAQs About Pre-Launch Satellite Insurance

Q: Is pre-launch satellite insurance mandatory?

A: No, but it’s highly recommended. Think of it as seatbelts—they’re not legally required everywhere, yet skipping them is plain dangerous.

Q: Can small businesses afford these policies?

A: Yes! Many insurers offer flexible plans tailored to different budgets. Plus, consider crowdfunding platforms that specialize in financing such endeavors.

Q: What if my insurer denies a valid claim?

A: First, take a deep breath. Then, consult legal counsel familiar with aviation law. Document EVERYTHING—you’ll need evidence to prove your case.

Conclusion

In the unforgiving realm of space exploration, preparation is king. Whether you’re safeguarding millions invested in state-of-the-art tech or simply protecting your peace of mind, pre-launch satellite insurance is non-negotiable.

To recap:

- Understand the risks unique to your operation.

- Partner with experienced brokers who get space stuff.

- Never sacrifice quality for short-term savings.

Before wrapping up, here’s a little reminder wrapped in haiku form:

Satellites ascend, But rockets sometimes explode— Insurance keeps calm.