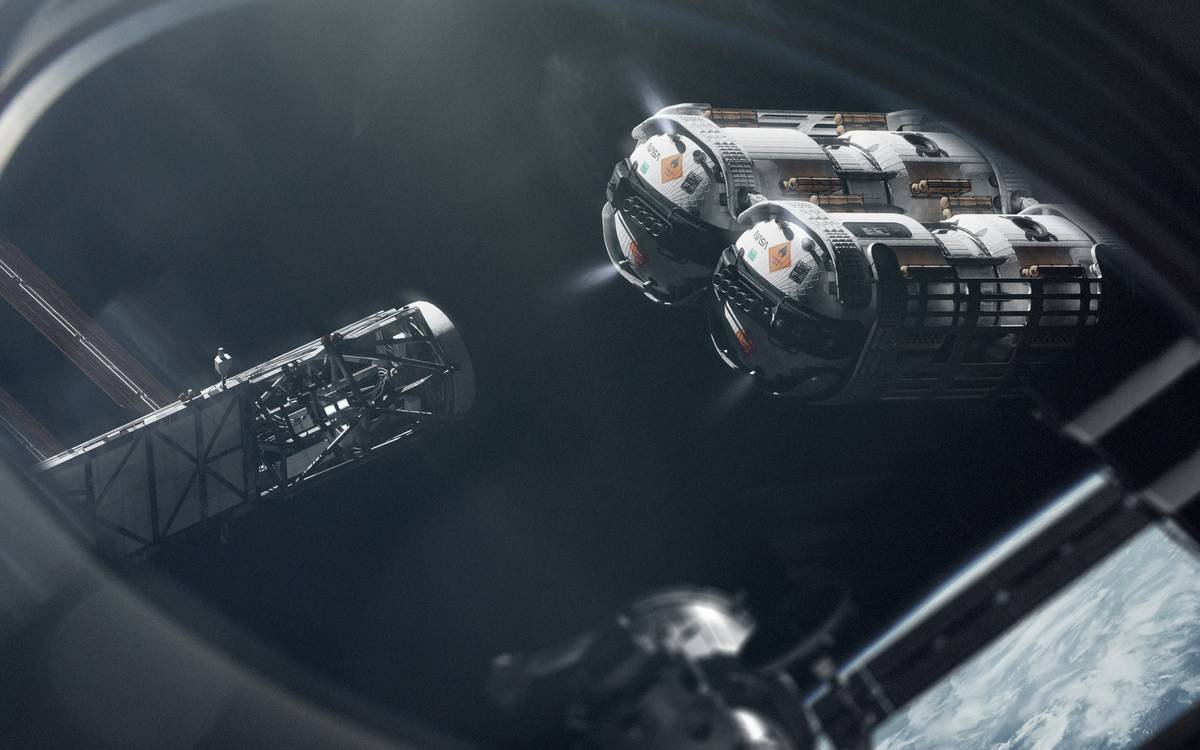

Ever wondered what happens if your satellite accidentally smashes into someone else’s orbiting equipment? Sounds far-fetched, but space collisions are becoming a real concern. With over 9,000 tons of space debris floating around Earth’s orbit—and growing daily—third party liability orbital coverage might just save you from financial ruin.

In this post, we’ll dig into the world of satellite insurance, explaining how third party liability orbital works, why it’s essential in today’s crowded skies, and tips to ensure you’re not caught off guard. Buckle up!

Table of Contents

- Why Are Satellites at Risk in Space?

- How to Protect Yourself with Third Party Liability Orbital Insurance

- 5 Tips for Choosing the Right Coverage

- Case Studies: When Third Party Liability Orbital Saved the Day

- Frequently Asked Questions About Satellite Insurance

Key Takeaways

- Satellite collisions: Increasingly common due to rising space traffic.

- Third party liability orbital: Shields you financially when your satellite damages another object in space.

- Premium optimization: Tailor your policy based on mission risks, satellite size, and operational lifespan.

Why Are Satellites at Risk in Space?

“The sky isn’t falling; something else is—your bank account—if you don’t have proper insurance.”

Sounds dramatic, right? But let me share one of my confessional fails: I once assumed that satellites were untouchable up there. Spoiler alert—they aren’t. A client forgot to add third party liability orbital to their launch contract, only to face millions in legal fees after an unexpected collision with defunct Russian hardware. Talk about whirrrr (like your laptop fan overheating, mid-crisis).

Here’s the deal: Space junk travels at speeds exceeding 17,500 mph. Even a tiny fragment can cause catastrophic damage. And guess who gets sued if your satellite crashes into theirs? Yep—you do. That’s where third party liability orbital comes in as your financial shield.

How to Protect Yourself with Third Party Liability Orbital Insurance

Optimist You: “I’ll never need insurance—it won’t happen to me.”

Grumpy You: “Ugh, fine—but only if coffee’s involved.”

Step 1: Assess Your Satellite’s Mission

Different missions carry different risk levels. For instance, low-Earth orbits (LEO) are more congested than geostationary ones. Talk to experts to understand potential hazards specific to your satellite’s trajectory.

Step 2: Compare Quotes from Reputable Providers

Not all insurers specialize in space-related policies. Look for companies experienced in third party liability orbital claims. Price varies significantly depending on factors like satellite mass, intended use, and expected lifetime.

Step 3: Customize Your Policy Limit

Underestimating limits could leave gaps in protection. On the flip side, over-insuring wastes money. Find a balance by analyzing worst-case scenarios and historical claim data.

5 Tips for Choosing the Right Coverage

- Tip #1: Work closely with brokers familiar with aerospace law.

- Tip #2: Prioritize providers offering 24/7 emergency response services.

- Anti-Tip Alert: Avoid cheap plans without reading fine print—they often exclude costly incidents involving sensitive military satellites.

- Tip #4: Review indemnity clauses carefully to prevent disputes later.

- Tip #5: Bundle third party liability orbital with other coverages like launch or in-orbit insurance for discounts.

“This tip list is basically chef’s kiss for avoiding cosmic chaos,” says any seasoned satellite operator ever.

Case Studies: When Third Party Liability Orbital Saved the Day

Example #1: In 2009, an Iridium satellite collided with a defunct Russian craft. Thanks to robust third party liability orbital coverage, Iridium avoided crippling litigation costs while continuing operations smoothly.

Example #2: SpaceX faced scrutiny after reports showed a near-miss incident with China’s Tiangong station. Their comprehensive third party liability orbital plan helped mitigate reputational fallout and ensured compliance with international treaties.

Frequently Asked Questions About Satellite Insurance

What exactly does third party liability orbital cover?

It protects against damages caused by your satellite impacting other objects in space, whether active or inert.

Is this type of insurance mandatory?

While not universally required, many countries mandate proof of such coverage before granting launch permits. Plus, commercial operators typically demand it.

Can I get coverage retroactively?

Unfortunately, no. Policies must be secured prior to launch.

How much does third party liability orbital cost?

Pricing depends on various factors but generally ranges between $50,000–$500,000 annually for standard LEO missions.

Do small satellites need insurance?

Absolutely! Size doesn’t matter here—a CubeSat can still wreak havoc if improperly managed.

Conclusion

Third party liability orbital may sound niche, but it’s non-negotiable in our increasingly cluttered cosmos. From protecting against collision lawsuits to ensuring peace of mind, investing in the right coverage pays dividends. So next time you gaze skyward, remember: Like a Tamagotchi, your satellite needs constant care—including solid insurance.