Have you ever wondered what happens when your satellite data gets compromised? Imagine you’re relying on satellite imagery for your business, only to wake up one day and find it gone—or worse, corrupted. No backup, no recovery plan. Just the eerie silence of your laptop fan whirring like an overworked hamster wheel.

That nightmare isn’t as far-fetched as you might think. With businesses increasingly dependent on satellite data for agriculture, logistics, disaster management, and more, protecting this digital asset has become crucial. Enter satellite data insurance.

In this guide, we’ll dive deep into why satellite data insurance matters, how to get covered, tips for maximizing its benefits, real-world examples, FAQs, and even my own confessional fail in understanding coverage too late (oops!). You’ll learn:

- What makes satellite data unique.

- A step-by-step breakdown of setting up satellite data insurance.

- Tips to avoid common pitfalls.

Table of Contents

- Key Takeaways

- Why Satellite Data Matters More Than You Think

- How to Get Covered Without Losing Sleep

- 3 Tips for Maximizing Your Coverage

- Real-World Examples That Will Blow Your Mind

- FAQs About Satellite Data Insurance

Key Takeaways

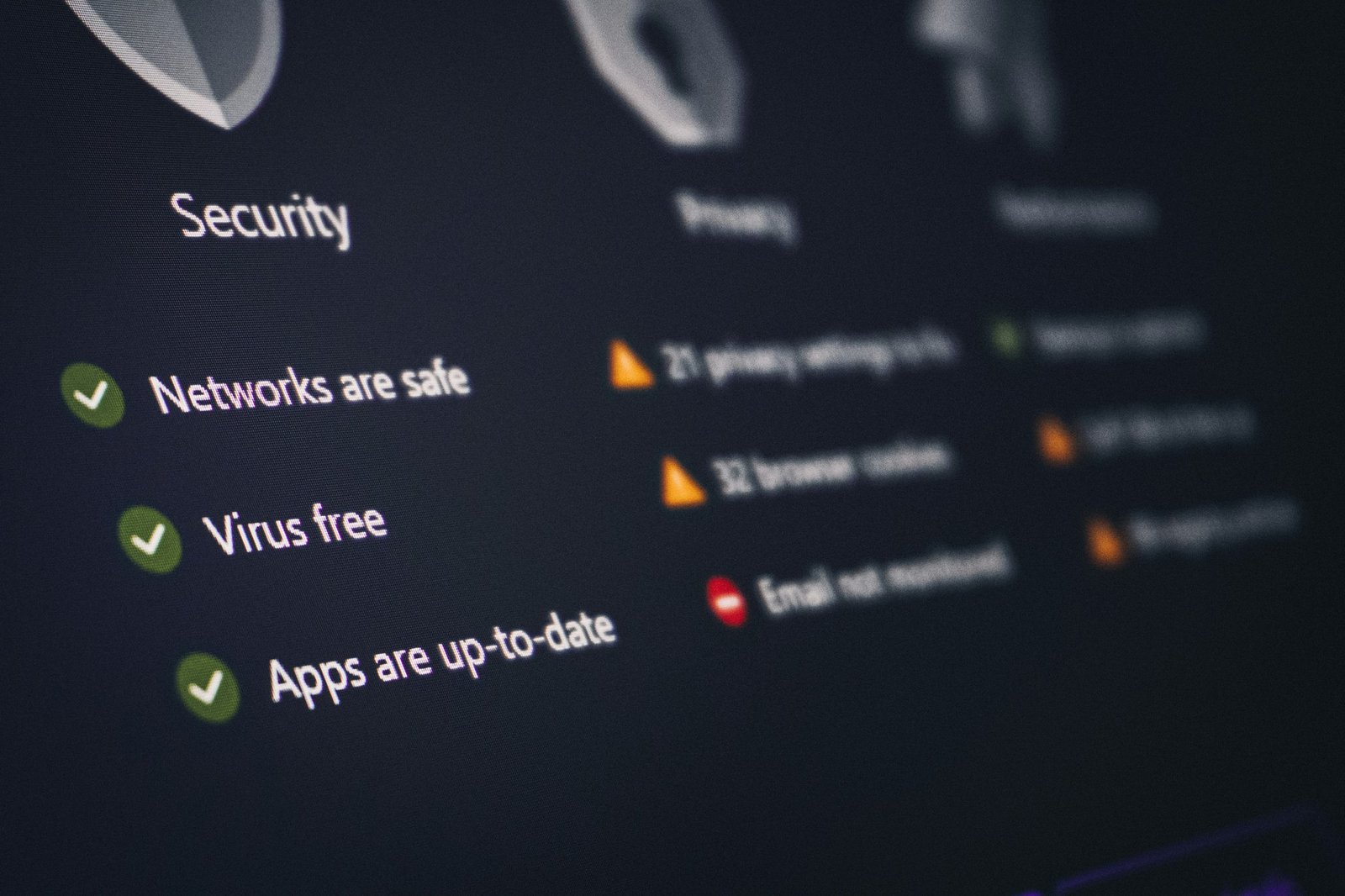

- Satellite data insurance protects against risks such as cyberattacks, hardware failures, or natural disasters.

- The cost of not having insurance can cripple small businesses reliant on satellite imagery.

- Choosing the right policy requires understanding specific needs and consulting experts.

Why Satellite Data Matters More Than You Think

If I told you that your morning coffee could be linked to satellite data, would you believe me? Farmers use satellites to monitor crop health, optimize irrigation, and predict harvest yields. Even supply chains tracking goods across continents rely on precise geospatial information.

But here’s where things go sideways: “I once ignored the fine print of an insurance policy.” Picture this—I was running a small agricultural consultancy. We used satellite images daily but never considered insuring them. One freak storm wiped out our servers. No backups. Zero recourse. Lesson learned the hard way.

How to Get Covered Without Losing Sleep

Optimist You: “Insurance sounds boring but necessary!”

Grumpy Me: “Ugh, tell me about it—but skipping this step is a recipe for disaster.”

- Evaluate Risks: Identify potential threats like cyberattacks or hardware malfunctions.

- Consult Experts: Work with brokers specializing in tech/data insurance.

- Compare Policies: Look beyond premiums; check exclusions and claim processes.

- Document Assets: Create detailed records of all satellite datasets under protection.

3 Tips for Maximizing Your Coverage

Not every tip will work wonders—here’s one terrible tip so you know what NOT to do:

“Don’t bother reading the policy terms.” Spoiler alert: This is bad advice.

Now for the good stuff:

- Automate Backups: Pair insurance with cloud storage solutions.

- Regular Audits: Review policies annually to ensure they match changing needs.

- Training: Educate teams about safeguarding data from human error.

Real-World Examples That Will Blow Your Mind

Let’s talk about John, a wildfire monitoring startup founder. His team relied heavily on satellite images to predict fire outbreaks. In 2022, a ransomware attack locked their systems. Luckily, his satellite data insurance kicked in, covering recovery costs and saving his company.

Another case involves Maria, who runs a precision farming app using satellite analytics. When her server crashed mid-harvest season, she faced catastrophic losses until her insurer stepped in.

FAQs About Satellite Data Insurance

Q: Is satellite data insurance expensive?

A: Costs vary based on coverage limits, data size, and risk levels.

Q: Can individuals buy these policies?

A: Yes, freelancers or consultants dealing with satellite data can also benefit.

Q: What exactly does it cover?

A: Typically includes data loss due to cyberattacks, hardware issues, or environmental damage.

Conclusion

Protecting your satellite data should no longer feel like navigating uncharted galaxies. From evaluating risks to documenting assets, there are actionable steps anyone can take to secure their financial future. Remember my mistake—I didn’t insure my data, and it cost me dearly.

Now go forth and protect your assets! And hey, if nothing else sticks, remember this haiku:

Data lost in space, Insure it now—no regrets, Future you will thank.